Daglish Asset FINANCE

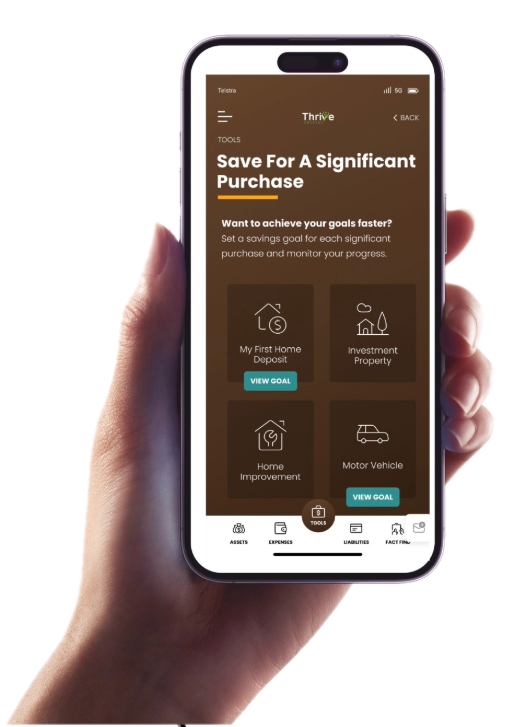

Asset Finance Daglish - Helping you to achieve your business goals. Whatever your business finance needs, we can help. We offer a range of services to help your business grow. Whether you are looking for new equipment, looking to expand or merge, our business asset finance expertise has you covered.

ASSET FINANCE Daglish

We’ll help you attain asset finance anywhere in NSW?

Some of the asset finance solutions we help with at Daglish :

- Business: Financing a new asset for your business? Our team will find your business the best asset finance for you.

- Medical: We have helped many medical practitioners finance medical equipment.

- Franchise: Ensuring you have the right equipment is essential to a smooth-running business. We can help you purchase new replacement equipment with a loan through our wide range of lenders.

- And much more – talk to us about your business today.

How we help Daglish businesses?

No matter what type of equipment you need, from heavy equipment financing to smaller office items, or equipment leases – we aim to find the best rate loans available, so you get the items you need as fast as possible. Not all asset loans are the same.

Our team of experts will draw from our extensive knowledge of loan options and a large portfolio of lenders to get you the perfect financial solution for your needs.

Lenders have more flexibility in negotiating loans but some large-scale lenders such as banks will have guidelines that they must adhere to. We will ensure that you meet these requirements and that the loan options selected are the best options for you.

Daglish asset finance to help your business grow.

Daglish Industries We Serve

We cater to a wide range of industries, including (but not limited to)

What we Finance - Daglish Asset Finance

We have a large range of trusted lenders and many connections within the Australian industry. Talk to our team today about what we can finance and how we can help you.

Our asset finance Daglish brokers will ensure you get the best loan for your needs.

Some of the equipment and assets we can find finance solutions for:

- Trucks and trailers: Our goal is to be your go-to provider for Truck Finance, eliminating the need for you to search elsewhere.

- Trailer Finance: We simplify the process of acquiring trailers with our specialisd financing solutions.

- Concrete Pump Finance: With our extensive range of lenders we can find you the best loan options for your concrete pump loan.

- Concrete Agitator Finance: We have customised financing solutions for concrete agitators, enabling you to acquire the essential equipment for your construction projects.

- Machinery Finance: For new or used machinery, whether it’s sourced privately or through a licensed dealer, our team can help secure the right financing options.

- Equipment Finance: Whether you’re looking to finance new or used equipment, from a supplier or a private seller, we can tailor equipment finance solutions.

- Excavator Finance: Our unwavering commitment lies in helping you acquire the earthmoving equipment you’ve located while providing unmatched service every step of the way.

- Bulldozer Finance: Provides tailored financing solutions for bulldozers, supporting businesses in the construction and earthmoving industry to acquire the necessary equipment.

- Agricultural Machinery Finance: we offer a diverse selection of financing solutions specifically tailored for agricultural machinery, providing you with the flexibility and choices you need to acquire the right equipment for your farming operations.

Daglish Asset Finance - What we Finance

Business Finance

- Low Documentation Finance: We provide low documentation finance options, streamlining the application process for individuals and businesses with minimal paperwork requirements.

- Business Acquisition Finance: Whether you are acquiring a small business, expanding through a merger, or purchasing a company in a different industry, we can tailor a finance package to suit your requirements.

- Business Loan Finance: Our team of experienced professionals will assess your business’s financial situation, provide valuable insights, and guide you through the loan application process.

- Debtor and Invoice Finance: We offer debtor and invoice finance solutions, providing businesses with a flexible and efficient way to manage cash flow.

- Bank Overdraft Finance: Whether you require funds to cover temporary shortfalls, manage unexpected expenses, or take advantage of growth opportunities, a bank overdraft facility can provide the working capital cushion you need to ensure the smooth operation of your business.

With our extensive connections with lenders across Australia, we help many businesses each day acquire asset finance.

Get in touch today to discuss your business and your asset needs.