CONCRETE AGITATOR FINANCE

Thrive Broking provides customized financing solutions for concrete agitators, enabling you to acquire the essential equipment for your construction projects. With competitive rates, flexible terms, and expert guidance, we support the growth and efficiency of your operations in the concrete industry.

CONCRETE AGITATOR FINANCE

We offer a range of finance options for Concrete Agitators.

Why Choose Thrive Broking?

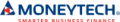

- Extensive network

- Tailored solutions

- Streamlined process

- Cost-effective options

- Great communication

We have a strong knowledge of the construction industry with many contacts and connections. We will get you the best-fit loan for your business.

Our goal is to provide our clients with the support and confidence they need when it comes to securing approvals for their agitators.

With a large range of lenders, we will make sure to find you the best loan and finance options for your business.

Why Choose Thrive Broking for Concrete Agitator Finance?

Looking for a long-lasting finance relationship for years to come? At Thrive Broking, we assure you that we are easy to deal with and provide a convenient and cost-effective service. We take charge of the entire application process for you, collaborating with all relevant parties, including your Concrete Agitator Dealership, Private Seller, Accountant, or Insurance

- Swift & Transparent Approval Process

- Approval without Financials*

- Relationship-Oriented Approach

- No Deposit Required*

- Concrete Agitator Finance Brokerage

- Efficiency & Cost-effectiveness

- Relationship-oriented Approach

Give us a call today at 0421 195 741 or reach out via email at emma@thrivebroking.com.au. Thrive Broking is your trusted partner for a seamless Concrete Agitator Finance experience.

* Subject to lenders criteria

We offer a World of Versatile Financing Solutions

Whether you’re a small startup or an established enterprise, our dedicated team of experts is here to guide you through the process and provide tailored financing options to suit your unique needs.

With a wide range of choices available, including flexible loan terms, competitive interest rates, and personalised repayment plans, we empower you to make informed decisions that drive your business forward.

Discover Tailored Financing Solutions for Your Concrete Agitator Needs

We understand the significance of concrete agitators in the construction industry and their vital role in ensuring efficient operations.

We help you to grow your business, contact us today to get started.

HAVE QUESTIONS? WE HAVE ANSWERS

Find answers to our most frequently asked questions. If you can’t find the information you’re looking for, don’t hesitate to get in touch. We’re here to assist you and provide the support you need.

Thrive Broking specialises in concrete agitator finance, providing expert assistance to make your purchase process easier and more convenient. We understand the unique requirements and challenges associated with financing a concrete agitator. By working with Thrive Broking, you can benefit from our expertise, extensive network of lenders, and competitive rates. Our dedicated team is committed to helping you find the best financing options for your concrete agitator, ensuring a seamless buying experience.

No, you don’t have to pay Thrive Broking directly for our services. We earn a commission from the lenders when we successfully arrange financing for your concrete agitator purchase. Our goal is to provide you with exceptional service and support throughout the financing process at no additional cost to you. You can rely on us to guide you through the concrete agitator finance journey without any upfront fees or charges.

At Thrive Broking, we finance a wide range of concrete agitators suitable for different applications and industries. This includes standard drum concrete agitators, volumetric concrete agitators, and specialised concrete agitator trucks. We understand the diverse needs of our customers and offer financing options for various types and sizes of concrete agitators.

Applying for concrete agitator finance with Thrive Broking is a simple process. You can start by contacting our experienced team through our website or by calling our dedicated customer support. Our team will guide you through the application, helping you gather the necessary documents and information. We work closely with you to understand your financial situation and concrete agitator requirements, enabling us to present suitable financing options for your purchase.

Low Doc Car Finance refers to a type of financing that caters to individuals and businesses who may not have complete financial documentation readily available. Instead of extensive financials, Low Doc Car Finance relies on alternative documentation and assessments to evaluate loan eligibility. This type of finance is particularly beneficial for self-employed individuals or small businesses who have a strong income but limited documentation to support their application. Thrive Broking offers Low Doc Car Finance options, providing a convenient solution for those with unique financial circumstances.

Note: For more detailed information or specific inquiries about Business Vehicle Finance, please feel free to contact our knowledgeable team at Thrive Broking.