Success Story! How we got a lower rate than a dealership

Turning Decline into Success: How Understanding Lending Criteria Led to an Approved Loan When your dreams get derailed by a finance rejection, it can feel

Turning Decline into Success: How Understanding Lending Criteria Led to an Approved Loan When your dreams get derailed by a finance rejection, it can feel

Buying a new car is an exciting milestone for many Australians. Whether you’re upgrading your current vehicle or purchasing your first car, it’s a significant decision that involves not just choosing the right model but also navigating the complex world of car financing.

When it comes to financing your next car, boat, caravan, or commercial asset, one of the most critical decisions you’ll face is whether to opt for a fixed or variable interest rate loan.

If you’re a small business owner or self-employed individual, accessing traditional financing options can be challenging due to stringent documentation requirements. However, there’s a solution tailored to meet your needs: a low doc car loan.

At Thrive Broking, we understand the challenges of managing multiple debts. That’s why we offer debt consolidation, which simplifies repayments by merging debts into a

If you’re launching a new business that requires a truck, securing a startup truck loan is a crucial step toward building your fleet and driving

When you’re looking to finance a car, boat, or caravan, or even that excavator or dump truck, understanding every detail of your loan agreement is

Owning a caravan opens up endless possibilities for travel and adventure, but mastering the art of towing it safely requires knowledge and practice. Whether you’re

Mitchell’s Journey to Financial Awareness. He was unaware of: the impact of credit enquiries on his credit file. Learn how to avoid the same situation.

Australian Consumer loans for self employed When applying for a business loan or a consumer loan as a self-employed individual in Australia, you’ll find that

In the intricate world of finance, where uncertainty lurks around every corner, one of the most crucial challenges facing businesses, investors, and financial institutions alike

Unlocking Agricultural Growth: A Comprehensive Guide to Types of Farm Loans” explores the integral role of Agribusiness. Agribusiness is deeply woven into the fabric of

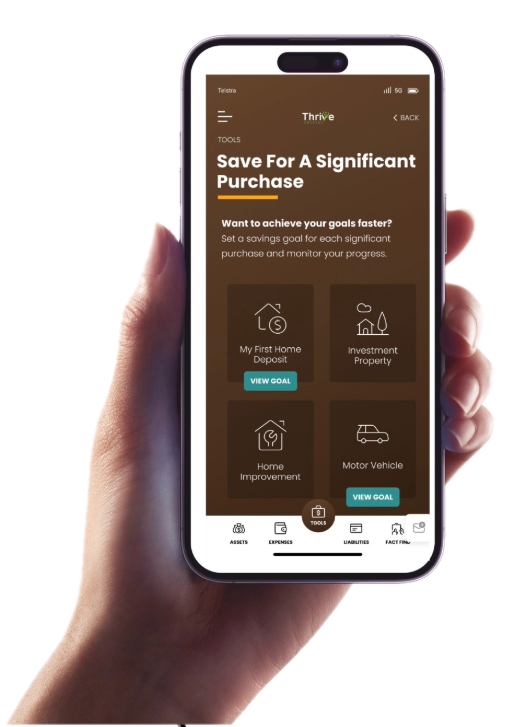

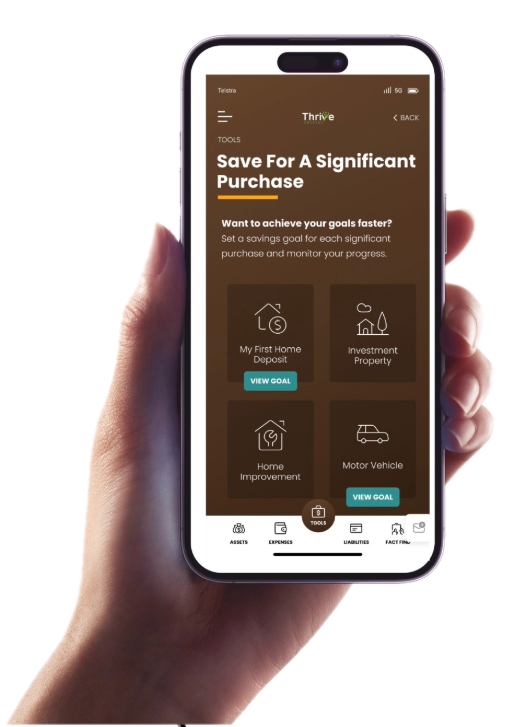

Our passion, is to help you thrive financially and live the life you want.

We are here to assist you, so please contact Emma at Thrive Broking. You can text or call during our working hours.

You can text Emma outside these hours and she will get back to you as soon as she is available.

We would like to acknowledge the Traditional Custodians of this land on which we work and live. We recognise and respect their continuing connection to the land, waters and communities. We pay our respect to Elders past and present and to all Aboriginal and Torres Strait Islander peoples.

Credit Representative 533755 is authorised under Australian Credit Licence 389328 | ABN: 68 654 047 54