LOW DOCUMENTATION FINANCE

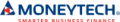

Thrive Broking provides low documentation finance options, streamlining the application process for individuals and businesses with minimal paperwork requirements. With flexible terms, competitive rates, and expert assistance, we make accessing financing solutions easier, ensuring a smooth and efficient experience tailored to your specific needs.

LOW DOCUMENTATION FINANCE

Thrive Broking, is your trusted source for Low Documentation Finance solutions.

Why choose Thrive Broking?

- Extensive network

- Tailored solutions

- Streamlined process

- Cost-effective options

- Great communication

We understand that traditional documentation requirements can sometimes pose challenges for certain businesses and individuals.

That’s why we offer flexible finance options that require minimal documentation, making the process easier and more accessible for you.

Our goal is to provide you with the ffinancial support you need, even when traditional lenders may not consider your application.

Contact us today to discuss your financing needs, and let us simplify the process for you.

Why Choose Thrive Broking for LOW DOCUMENTATION FINANCE?

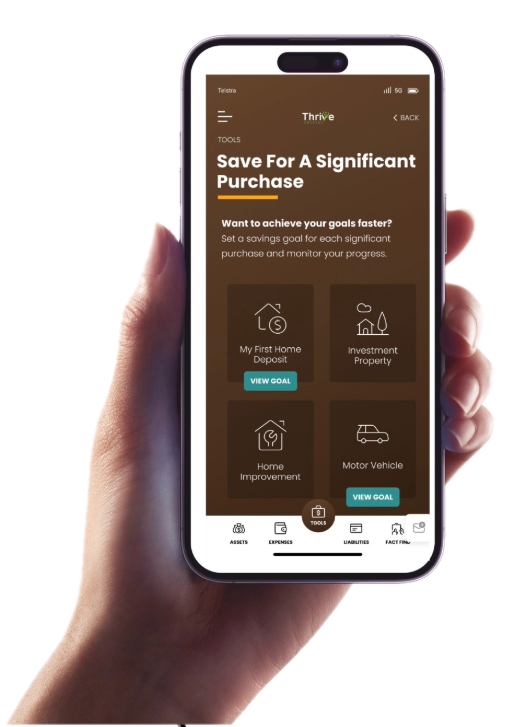

At Thrive Broking, we possess comprehensive knowledge of every “Low Doc” Finance offer available from 60 Banks and Lenders in the market. This expertise grants us access to a diverse range of funding options, enabling you to scale your business rapidly, without the delays associated with traditional financing methods. What sets us apart is our ability to secure these funding solutions with minimal questions from the bank or lender.

- Low Doc Approvals

- Excellent Rates

- Quick & Clear Approval Process

- Personalized Service

- Relationship-Focused and Lifetime Support

- No Deposit Required*

- Expert Knowledge on all Low Doc Policies

- Approvals with Minimal to No Ffinancials*

Give us a call today at 0421 195 741 or reach out via email at emma@thrivebroking.com.au. Thrive Broking is your trusted partner for a seamless Low Documentation Finance experience.

* Subject to lenders criteria

We offer a Wide Range of Low Documentation Finance Options

Trust Thrive Broking to guide you through the world of low documentation finance, unlocking opportunities and empowering you to achieve your ffinancial goals.

Explore our range of options today and take the first step towards a brighter ffinancial future.

Unlock the Potential of Low Documentation with Tailored Financing Solutions

We specialise in providing simplified, yet professional financing options designed to suit your unique circumstances.

Our team of experts is dedicated to helping you thrive by offering personalised solutions that unlock opportunities and enable you to achieve your ffinancial goals.

With Thrive Broking, you can embark on a path towards success, as we unlock the potential of low. documentation for your benefit.

HAVE QUESTIONS? WE HAVE ANSWERS

Find answers to our most frequently asked questions. If you can’t find the information you’re looking for, don’t hesitate to get in touch. We’re here to assist you and provide the support you need.

Low Documentation Finance, commonly referred to as Low Doc Finance, is a type of financing option that is designed for individuals or businesses who may not have access to traditional ffinancial documentation, such as tax returns or ffinancial statements. With Low Doc Finance, the emphasis is placed on alternative forms of verification and assessment of income and creditworthiness, making it easier for self-employed individuals or those with limited ffinancial documentation to secure financing.

Low Documentation Finance offers flexibility and accessibility for individuals or businesses that may face challenges in providing comprehensive ffinancial documentation. It allows self-employed individuals, freelancers, or those with irregular income streams to access the financing they need for various purposes, such as purchasing assets, expanding their business, or investing in property. It can be a convenient option for those who have a strong income but lack the traditional ffinancial documents required by conventional lenders.

The specific requirements for Low Documentation Finance can vary depending on the lender and the nature of the loan. While the exact documentation requirements differ from lender to lender, you can generally expect to provide alternative forms of income verification, such as bank statements, business activity statements, or a self-declaration of income. Additionally, lenders may consider factors such as credit history, assets, and equity when assessing your eligibility for Low Doc Finance.

Low Documentation Finance can be used for various purposes, including but not limited to home loans, vehicle finance, equipment financing, and small business loans. Whether you need to purchase a property, invest in business equipment, or finance a vehicle, Low Doc Finance provides a flexible solution to help you secure the funds you require.

To apply for Low Documentation Finance, you can start by contacting a reputable finance provider or broker that specialises in this type of financing. They will guide you through the application process, assisting you in gathering the necessary documentation and assessing your eligibility for Low Doc Finance. It’s important to work with an experienced professional who can help you navigate the requirements and find the most suitable financing solution for your specific needs.