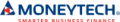

Thrive Broking offers personlised financing solutions for individuals seeking to purchase a vehicle. With competitive rates, flexible terms, and expert guidance, we make owning your dream car a reality, providing convenient financing options tailored to your personal preferences and financial goals.

Get personalised loan options based on your circumstances

An unsecured loan requires no collateral.

- $5K – $70k

- You can repay weekly, fortnightly or monthly

- 3, 5 or 7 year loan terms¹

- Know exactly what you’re paying for. No hidden costs. No balloon payments. No surprises.

A secured loan is backed by security, in this case, your car. That means we can offer you a lower interest rate in comparison to unsecured loans.

- Secured car loans access higher loan amounts

- Private Sales on a Secured basis

- Secured car loans tend to attract slighly lower fees on average, due to the lower perceived risk

- Save more in interest costs with our secure car loan option.

We compare over 30 Australian car finance companies for the best options that will suit you.

We’ll find you competitive rates from a selection of our trusted lenders.

We’ll give you all the facts and we know who to apply to and what to provide in order to get you finance that fits you for your desired outcome.

You’ll need insurance when getting a loan and we can also assist you here.

We have access to insurance from reputable insurers and you can also get your own quotes.

Loan insurance and car insurance options can be packaged with your finance to streamline your new car purchase.

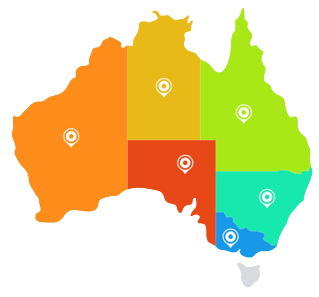

Next to this caption you’ll see one of our happy car finance clients who needed a reliable work vehicle for his trade. You can see the kids are loving it too.

The finance can cover the accessories to carry your tools securely.

Welcome to Thrive Broking, the trusted partner for Personal Vehicle Finance solutions. We understand that purchasing a vehicle is a significant decision, and our primary aim is to provide you with factual information and suitable financing options so you can make an informed decision, making your dream vehicle a reality.

At Thrive Broking, we specialise in offering tailored financing solutions to suit your personal vehicle needs. Whether you’re interested in buying a new or used car, a motorcycle, or any other type of personal vehicle, we have the expertise and resources to assist you. Our dedicated team will work closely with you, taking into consideration your preferences, budget, and financial situation to ensure that you secure the most suitable financing package.

We provide a range of flexible loan options designed to meet your personal vehicle financing needs. Whether you prefer a fixed-rate loan or a variable-rate loan, we can guide you in selecting the option that aligns with your financial goals. Our team will explain the loan terms, interest rates, and repayment options, empowering you to make an informed decision that suits your needs.

We understand that the financing process should be straightforward, and convenient for you. That’s why we have streamlined our application process so you can sit back in your chair with your feet up while you apply for your personal vehicle loan. Our team will assist you in gathering the necessary documentation, and we will handle the paperwork on your behalf. Our aim is to make the process efficient, minimising your time and effort.

At Thrive Broking, we go beyond being a finance provider. We are committed to providing expert guidance and support throughout your personal vehicle financing journey. Our team of experienced professionals will be there to answer your questions, address any concerns, and ensure that you have a clear understanding of the terms and conditions of your loan. We are here to support you every step of the way.

Choose Thrive Broking for your Personal Vehicle Finance needs and experience a partnership that puts your needs first. Let us help you secure the financing you need to drive away in your dream vehicle. With our personalised service and tailored solutions, we strive to make your vehicle ownership journey a smooth and enjoyable one.

Keep your business moving with low rates.

Personal Asset Finance

Welcome to Thrive Broking, your personal finance ally. We offer a variety of finance solutions tailored to your unique lifestyle needs, helping you to achieve your personal goals with excitement and confidence.

Our personal finance solutions include:

- Personal Vehicle Finance

- Motorbike Finance

- Caravan Finance

- Boat Finance

- Personal Loans

- Horse Float Finance

- Consumer Secured Car Loan

Trust Thrive Broking with your personal finance needs, and experience a smooth journey towards your financial goals. Let us help you turn your personal dreams into reality.

For prompt, friendly and professional consultation, we welcome you to reach out and contact us at 0421 195 741. Let Thrive Broking assist you to achieve personal satisfaction and success.

Operating Lease

Available to ABN holders who wish to lease the vehicle for a loan term between 1 to 5 years and at the end of the period wish to return the vehicle to the lender.

Novated Leasing

A three-way arrangement between your employer, a finance company and you. Finance the purchase price and running costs of your car.A salary packaging option to pay less tax where the employer pays the leasing company prior to paying the employee wage.Flexible loan terms of 1 to 5 years.

Chattel Mortgage

Secured loans for ABN holders when the vehicle is used for predominantly business purposes. Claim GST on the purchase price of the vehicle on your Business Activity Statement (BAS).Can lower your payment by applying a residual (balloon) payment. Flexible loan terms to 5 years to suit your specific situation.

HAVE QUESTIONS? WE HAVE ANSWERS

Find answers to our most frequently asked questions. If you can’t find the information you’re looking for, don’t hesitate to get in touch. We’re here to assist you and provide the support you need.

Eligibility requirements for personal vehicle finance vary depending on your individual circumstance as well as the lender. However, common criteria include being of legal age, having a stable income, and a good credit history. Lenders may also consider factors such as employment stability and existing financial commitments. Thrive Broking can help you understand the specific eligibility criteria and find lenders that align with your circumstances.

At Thrive Broking, we understand that not everyone has a perfect credit history. Even if you have bad credit, we could assist you in exploring alternative lenders who specialise in providing personal vehicle finance to individuals with less-than-ideal credit scores. While bad credit may limit your options, our team can work with you to find suitable financing solutions tailored to your situation.

Yes, it is often possible to pay off your personal vehicle loan before the agreed-upon term ends. This is known as early repayment or loan prepayment. However, it is important to review the terms and conditions of your loan agreement, as some lenders may impose prepayment penalties or fees. Thrive Broking can help you understand the specifics of your loan agreement and determine if early repayment is a viable option for you.

Applying for personal vehicle finance with Thrive Broking is a straightforward process. You can begin by filling out our online application form, providing details about your personal information, employment, income, and the desired loan amount. Once we receive your application, our team will review it and guide you through the next steps, including submitting any necessary documentation and assisting you in finding the best financing options for your personal vehicle purchase.

When selecting a personal vehicle finance option, several factors should be taken into consideration. These include the interest rate offered by the lender, the repayment term, any additional fees or charges, and the overall cost of the loan. It’s essential to assess your budget and determine a repayment plan that fits comfortably within your financial means. Thrive Broking can assist you in comparing different financing options, evaluating their terms, and finding the most suitable solution for your personal vehicle purchase.