BECOME A THRIVE BROKING PARTNER TODAY

Become a Strategic Partner and Better Support Your Clients with Thrive Broking!

We Will Make You Look Great.

Giving your clients the ultimate customer service is the way we ensure you always look great. Talk to Thrive Broking today about becoming a trusted referral partner.

We know that choosing anyone as referral partner requires deep trust in the professionalism of that partner and that’s why you’ll be impressed with our end to end service in gaining the right finance solutions for your clients.

Our aim is always to make you look great and have your clients thank you for referring them to us.

To do this we’ll build a relationship with you that understands how you do things and make your process easier.

Let us show you that we will go above and beyond every time for your referrals so you can get them the assets they need and want to grow their business and drive a rewarding lifestyle.

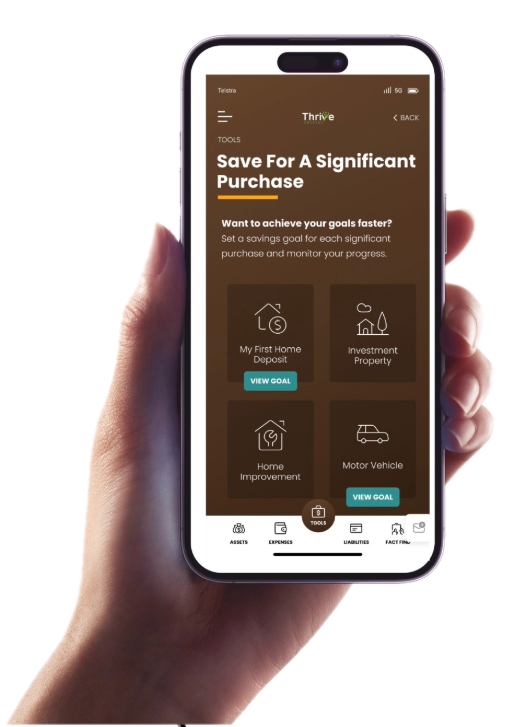

So, please reach out and talk to us about becoming a referral partner. Along with our great people we have fantastic technology so give us a call or fill in the form above.

Emma Murphy

Principal – Thrive Broking

Referral Partner Benefits with Thrive Broking

Better Finance Solutions For Your Clients

The better the deal we can find for your client, the more they’ll love you for recommending to talk to us. That’s why we provide exceptional service to all our clients. We explain everything, keep you and them informed, get back to you fast on any of your enquiries. This is a constant theme in all the great feedback we constantly receive.Commitment To Navigating Difficult Finance Challenges

No two customers are the same and it can often take a more detailed look at a clients situation to identify the right way forward to financing challenges. This is where we excel and exceed our partners expectations time and time again.Respected Relationships Across Our Lenders

Our commitment to your clients and our trusted relationships throughout lending networks means we commonly negotiate and facilitated better deals for clients. This increases purchase power to get the right equipment from the start.

Your Business Can Thrive

Our mission is to enable you and your clients to build thriving businesses and enjoyable lifestyles. That’s why we combine old fashioned customer service and hard work with a commitment to constant innovation in the way we improve our service to you.

Industries We Serve

We cater to a wide range of industries, including (but not limited to)

EARTHMOVING

TRANSPORT & LOGISTICS

CONSTRUCTION

HEAVY ENGINEERING / Industrial

FORESTRY

AGRICULTURAL / FARMING

MANUFACTURING

HEALTHCARE

MINING

Frequently Asked Questions

By partnering with Thrive Broking, you gain access to a range of valuable benefits for your business. We specialise in Asset Finance and have been recognised with numerous awards for our expertise in this field. With our in-depth industry knowledge, we can assist you secure the right loans for your clients while offering an excellent additional service.

We go the extra mile to ensure a smooth and efficient application process for your customers. Our team is well-versed in the interest rates and lending policies of various banks, allowing us to provide informative and cost-effective solutions. Having a single point of contact for all your clients’ finance needs adds significant value to your business.

Unlike dealing with a Bank Manager or other brokers, we understand the right strategies to facilitate approvals for your customers. We eliminate the need for lengthy application forms and ensure there are no delays or communication gaps. Our strong communication channels enable all parties involved to stay well-informed, resulting in a seamless finance process.

Choose Thrive Broking as your referral partner and experience the advantages of our industry expertise, efficient processes, and exceptional communication.

No, there is no charge for utilising Thrive Broking’s services. We are proud to offer our assistance as a completely complimentary service for both you and your customers. In fact, as a token of our appreciation for allowing us to support your clients, we offer you a Referral Commission. This means that while our services are complimentary, you have the opportunity to earn a commission by referring your clients to us.

At Thrive Broking, we prioritise a hassle-complimentary and streamlined finance application process, minimising the paperwork involved. To begin the application, we believe in understanding your customer and their business, as every finance application is unique.

To get started, all we require from you is your customer’s name, phone number, email address, and the specific loan they require. Once you provide us with this information, our team will take over and handle the rest. We will reach out to your client directly, ensuring a seamless experience throughout the application process. We are committed to making the process as smooth as possible for both you and your client.

At Thrive Broking, we understand that interest rates play a crucial role in financial decisions. We take pride in offering market-leading interest rates to our clients, thanks to the volume of assets we finance.

It’s important to note that every customer is unique, with their own business journey and financial circumstances. Our primary objective at Thrive Broking is to provide exceptional service and long-term support to our clients throughout their business ventures.

The reason we have gained a loyal customer base is not only because of our outstanding service but also because we consistently secure competitive interest rates. If our rates were high, we wouldn’t have the repeated trust and patronage from countless business owners.

As a Referral Partner, you benefit from our strong relationships with banks and financiers, which are built upon the volumes of assets we finance and the quality of our application submissions. This grants us preferential interest rates, giving us a significant advantage in keeping our customers satisfied and also benefiting our Referral Partners.

Rest assured, when you choose Thrive Broking, you can expect excellent service, market-leading interest rates, and a commitment to your long-term success.

It depends. At Thrive Broking, we have access to a diverse range of low doc and no doc finance options offered by major banks and other financiers. This means that your clients may not have to worry about providing extensive financial information to secure their finance approval, such as completed financials or tax returns.

During our phone conversations with your clients, we will determine the key items required to secure their finance approval. You might be surprised at how little information we actually need to proceed.

While financials and ATO portals can be beneficial, they are not necessary for loan sizes below $300k or to secure the best possible deal for your clients. We strive to simplify the process and provide flexible financing solutions tailored to your clients’ specific needs.

The interest rate on assets like motor vehicles, trucks, machinery, and more can be influenced by various factors. Here are some key considerations that affect the interest rate for customers:

Business tenure: The length of time your client’s business has been operating can impact the interest rate. Established businesses with a trading history of over 2 years may secure more favourable rates compared to brand new businesses.

Asset age: The specific year build of the asset plays a role. New or nearly new vehicles or machinery tend to qualify for lower interest rates compared to older assets, such as those built in 2003.

Property ownership or renting: Whether you or your spouse are property owners or currently renting can influence the interest rate. Property ownership may have a positive impact on the rate.

Total loan amount: The total amount of the asset loan also plays a part. Higher loan amounts for trucks or equipment may result in lower interest rates.

Previous finance and repayment history: Having a history of truck or equipment finance and maintaining a good repayment record can affect the interest rate. A positive repayment history may contribute to more favourable rates.

Credit file: The condition of your credit file, including factors like a low credit score or credit defaults, can impact the interest rate offered.

These are just some of the factors that can influence the interest rate on car, truck, or machinery purchases. At Thrive Broking, we consider these factors and work diligently to secure competitive interest rates tailored to your specific circumstances.

At Thrive Broking, we have the ability to finance assets regardless of their age or year build. Whether your client is looking to finance a brand new vehicle or a truck from as far back as 1985, the answer is always yes. We understand that different clients have diverse needs, and we are committed to providing financing solutions that cater to their specific requirements.

At Thrive Broking, we prioritise speed and efficiency when it comes to finance approvals. Typically, we can secure a finance approval for your customer within the same day or within 2 days after receiving all the necessary customer details.

To expedite the application process, we have streamlined our approach by eliminating application forms that can potentially slow down the process while waiting for customers to complete them.

We understand the importance of acting quickly, especially when a client is eager to make a purchase. Throughout the process, we will maintain open communication with you, providing exact timelines and keeping you informed at every stage of the deal. Our goal is to ensure a swift and seamless experience for you and your customers.

The loan term for asset finance typically ranges from 3 to 7 years (36 to 84 months). The specific duration of the loan term is ultimately a decision made by the client, taking into consideration their cash flow requirements.

Choosing a shorter loan term will result in higher monthly repayments since the loan is paid off over a shorter period. On the other hand, opting for a longer loan term will lower the monthly repayment amount.

If you or your clients would like to explore different loan term options for a truck or any other asset, we encourage you to use our user-friendly Finance Calculator. It allows you to experiment and find the loan term that best aligns with your financial needs. Feel complimentary to access the calculator at this link: Finance Calculator – Thrive Broking

The loan term for asset finance typically ranges from 3 to 7 years (36 to 84 months). The specific duration of the loan term is ultimately a decision made by the client, taking into consideration their cash flow requirements.

Choosing a shorter loan term will result in higher monthly repayments since the loan is paid off over a shorter period. On the other hand, opting for a longer loan term will lower the monthly repayment amount.

If you or your clients would like to explore different loan term options for a truck or any other asset, we encourage you to use our user-friendly Finance Calculator. It allows you to experiment and find the loan term that best aligns with your financial needs.

A balloon payment refers to a lump sum amount that is due to the lender at the end of an asset’s loan term, following the completion of all regular monthly repayments. It allows clients to repay only a portion of the principal loan amount over the requested term, thereby reducing their monthly repayments and improving cash flow.

At Thrive Broking, we have the capability to secure balloon payments for our clients. When the loan contract reaches its end, the client will still have the balloon payment remaining. However, there are options available to manage this payment effectively. One option is to refinance the balloon payment, making it easier to handle. Alternatively, the client can choose to trade in their asset for a new one or sell it to another party, ensuring that the transaction is structured in a way that covers the balloon payment amount.

The decision to include a balloon payment in the loan structure is entirely up to the customer. We can collaborate with them to determine the most suitable repayment plan that aligns with their business objectives. Our team will guide them through the process and help them make an informed decision regarding their loan structure.

At Thrive Broking, we specialise in providing tailored finance solutions for both new and used assets. Regardless of whether your clients are looking to finance a new or pre-owned asset, we have a diverse network of banks and lenders who are more than willing to finance used assets. We understand that used assets hold great value and can be an excellent investment for businesses. We can assist you in securing the financing needed for your clients’ used asset purchases.

At Thrive Broking, we take great pride in being able to offer the most competitive interest rates in the market. We understand that receiving a quote that seems expensive can be concerning. We have the expertise and resources to review your customer’s current quote and strive to beat it. Our goal is to provide you and your client with a better financial solution while ensuring you look great in front of your client.

However, if we find that your customer’s current interest rate is already exceptional, we will honestly communicate that to you. Our commitment is to always provide genuine feedback based on a thorough evaluation of your customer’s profile, the asset being purchased, their existing repayment structure, and the stage of their business.

When given the opportunity, we will go above and beyond to secure low interest rates and favourable repayment terms for your customer. Trust us to deliver an outstanding financing experience for your clients.

At Thrive Broking, we work with a diverse range of banks and financiers who offer approvals without requiring your client to put their own cash reserves as a deposit for the asset purchase. In most scenarios, the absence of a deposit won’t negatively impact the interest rate. We commonly facilitate asset loans with no deposit required, making it easier for your client to access the financing they need. We can explore financing options that suit your client’s situation and ensure a smooth and efficient application process.

At Thrive Broking, we have the expertise and experience to secure loan approvals for clients with low credit scores. We understand that a low credit score or credit defaults may not accurately reflect your client’s current financial situation. Often, there are valid reasons behind credit defaults, such as missed payments due to address changes or disputes over billing charges.

We take the time to understand why your client’s credit score is below average and effectively communicate their unique circumstances to the appropriate banks or lenders. Our goal is to provide a clear and compelling story about their credit score or credit defaults, ensuring the best possible chance of approval for their truck loan.

Additionally, we have a strong external team that we can leverage to assist in lifting credit defaults off your client’s credit file. This helps in improving their creditworthiness and securing the most favourable deals for them.

We have the knowledge and resources to navigate the complexities of credit scores and credit defaults, ultimately working towards getting your client’s truck loan approved.