Wedding Finance: BECAUSE YOU DESERVE TO HAVE AN AMAZING DAY

Wedding are a celebration of love and family and the start of a lifetime journey of adventure together. But they can be expensive because you are still young and getting established. We provide Wedding Finance so you can start your life's adventure properly and share the fun with all your family and friends and not leave anyone out.

Personal Finance Form

Weddings Loans

You’re planning to say I do and we’re so happy for you!

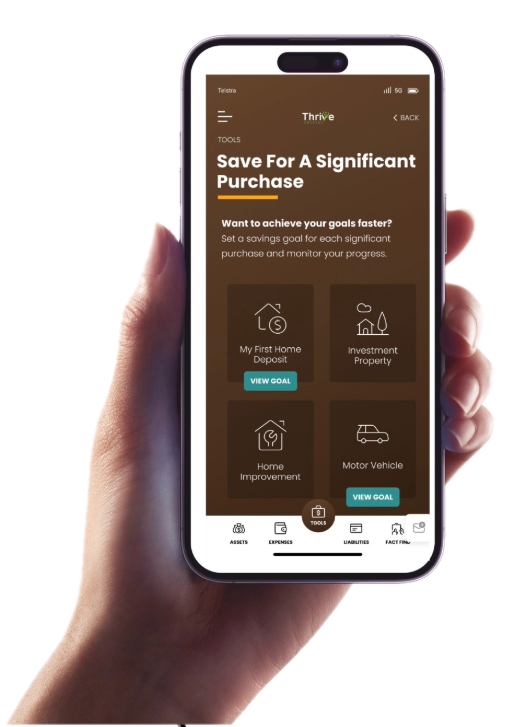

Planning a wedding and honeymoon is exciting and challenging. That’s why a wedding loan from Thrive Broking enables you to plan the wedding and honeymoon you deserve and give your family and friends the best wedding experience so no one feels left out.

Our wedding loans take off the emotional pressure to keep everyone happy and the financial pressures it puts on you because you can now do what you want to do and include the people you love without compromise.

From your amazing dress, to the stunning venue, the guest list and catering choices, plus all the working parts in between, you know that the costs can quickly add up.

Fortunately, wedding loans offer a practical solution to help you manage these expenses without compromising on your dream day.

Why Consider a Wedding Loan?

A wedding loan, like those offered by Thrive Broking, provides a convenient way to finance the wedding you really want. Here are some reasons to consider this option:

-

Immediate Access to Funds: With a wedding loan, you can secure the funds you need promptly, allowing you to book suppliers, venues, and other services without delay.

-

Fixed Interest Rates: Knowing exactly what your monthly repayments will be helps you plan your budget effectively. Fixed interest rates provide stability and predictability.

-

Flexible Repayment Terms: You can choose a repayment plan that fits your financial situation, whether that means paying off your loan quickly or spreading the cost over several years.

-

Preserve Savings: Instead of dipping into your savings or honeymoon fund, a wedding loan allows you to finance your wedding without depleting your financial reserves.

Wedding Cost Breakdown In Australia

The average cost of a wedding in Australia in 2024 ranged from $36,000 to $51,000

| Wedding Expense | Average Cost | What to Consider |

| Venue | $14,758 | Considered one of the most substantial expenses. Booking popular venues may require advance planning, potentially at least 12 months ahead. |

| Bridal Gown | $2,304 | Choices include custom-made, brand new, or second-hand gowns with adjustments. Hiring a dress is also an option for budget-conscious brides. |

| Flowers | $1,844 | Costs vary based on the type and quantity of flowers. Exploring fake flowers could be a cost-effective alternative to real floral decorations. |

| Catering | $5,429 | Typically charged per head, costs increase with a higher number of guests. Consider your guest list size when estimating catering expenses. |

| Photography | $3,164 | Preferences for candid or posed photos, or a combination, affect the photographer’s time commitment and, subsequently, the overall cost. |

| Entertainment | $1,080 | Costs vary based on the choice of entertainment, such as hiring a DJ or a live band for the reception. |

| Wedding Car Hire | $1,137 | Cost depends on the number of vehicles needed and the duration of hire. |

Looking for a venue?

Thrive Broking is partnered with Hunter Events Group! Together we can help you achieve your dream wedding.

Tips for Managing Your Wedding Budget

- Prioritise Your Expenses: Identify the most important elements of your wedding and allocate your budget accordingly. This helps ensure you don’t overspend on less critical items.

- Track Your Spending: Keep a detailed record of all wedding-related expenses to avoid any surprises. This also helps you stay within your budget.

- Negotiate with Suppliers: Don’t be afraid to negotiate prices with suppliers. You might be able to secure discounts or added value by discussing your budget constraints with them.

- Consider Off-Peak Dates: Choosing an off-peak date for your wedding can significantly reduce costs. Many venues and suppliers offer lower rates for weddings held on weekdays or during less popular seasons.

With careful planning and the right financial support, you can create the wedding of your dreams without the stress of financial strain. A wedding loan from Plenti can provide the funds you need to make your special day truly unforgettable.

Give us a call today at 0421 195 741 or reach out via email at emma@thrivebroking.com.au. Thrive Broking is your trusted partner for a seamless Wedding Loan experience.

HAVE QUESTIONS? WE HAVE ANSWERS

Find answers to our most frequently asked questions. If you can’t find the information you’re looking for, don’t hesitate to get in touch. We’re here to assist you and provide the support you need.

A wedding loan is a type of personal loan specifically designed to cover the expenses associated with planning and hosting a wedding. It provides you with the necessary funds upfront, which you then repay over a set period with interest.

The amount you can borrow depends on your financial circumstances and the lender’s criteria. Thrive Broking, for example, offers personal loans that can be tailored to your specific needs, allowing you to borrow the amount necessary to cover your wedding expenses.

Interest rates for wedding loans vary based on the lender, your credit score, and your financial history. Fixed interest rates are common, providing you with consistent monthly repayments.

You will typically need to provide personal information such as your name, address, and date of birth, as well as financial details like your income, employment status, and existing debts. You may also need to specify the amount you wish to borrow and the purpose of the loan.

Approval time may vary by lender but the process is usually quick. Once you submit your application, it will be reviewed promptly, and if approved, you could receive your funds within an hour at the earliest or overnight at the latest.